Rpa In A Series Of Steps

GettyOne of the current trends in financial services is the increased awareness and adoption of (RPA). RPA can be utilized in any process within your financial institution, but if you are looking to get on board, a good starting point is your know your customer (KYC) process. However, there are several factors to consider before deciding to implement RPA. Let’s take a look at what you need to know about RPA in the context of your KYC process.How RPA Works With The KYC ProcessKYC is a key part of an effective anti-money-laundering (AML) framework and mandates that a bank perform customer due diligence to ensure they are not enabling financial crimes to occur. For most financial institutions, the KYC process is a series of routine and repetitive procedures across different customers that are being onboarded.

In some larger financial institutions, the tasks are even repeated across different departments that deal with the same customer.

Rpa In A Series Of Steps Lyrics

Robotic Process Automation (RPA) simplifies HR processes for a global MNC The clientInfosys BPM’s client is an MNC providing business consulting, information technology and outsourcing services to over 1000 clients across 50 countries. The Business ChallengeOwing to its large global footprint, the client has employees working in numerous offices across the world. Its HRO function handles a variety of processes including talent acquisition, talent administration, talent development, employee life cycle, employee experience, compensation and benefits support, and HR reporting.

Each of these processes were composed of several activities that were not only effort-intensive but also crucial for employee satisfaction.Because of the size of the client which had grown rapidly, its HR function was faced with the challenge of efficiently handling an enormous volume of transactions. It needed to meet the time-critical needs of business while compromising neither on quality and compliance requirements nor employee satisfaction. Cyberghost vpn premium crack. Determining automation scopeInfosys BPM studied the client’s HR processes and analyzed each of their stages in detail to understand the suitability of introducing Robotic Process Automation (RPA) and reducing the effort involved in dealing with the quantum of data.Following the study, Infosys BPM created use cases for deployment of automation. The ideal process candidates for RPA are deterministic or rule-based in nature.

RPA lends itself particularly well to activities such as:. Reading / copying / synchronization of data between web applications, ERP, backend systems. Validation / verification of extracted data.

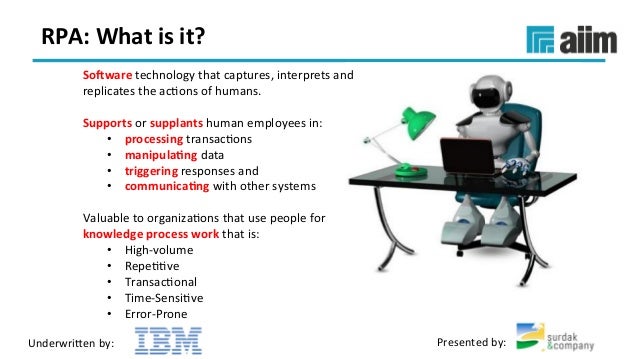

Blue Prism is a UK-based software development company in the field of Robotic Process Automation. The group supplies software robot which helps to automate clerical back office processes that work exactly like a human. The Robotic Process Automation which is shortly known as (RPA) was invented. RPA is all about automating the daily tasks performed by humans in any business. These daily, mundane and repeatable tasks include copying and pasting data from one system to another, clicking buttons, logging in to various applications, transferring data between applications. Millions of employees.

Reading data / attachments from email. Sending emails / mass mailers.

Scheduling of meetings. Data standardization. Data logging for audit purposesThe study revealed several such processes that could be successfully automated based on their volumes, average handling time, and risk of error.

Rpa In A Series Of Steps Free

Infosys BPM categorized the various stages of the processes into four buckets based on the scope for automation: Very High, High, Medium, and Low. The results of the study are presented in the figure below.Figure 1: HRO RPA Applicability Use Cases Our SolutionInfosys BPM automated several of the processes identified during the scope study. The automation reduced the manual intensive aspects of the work, while speeding up the processes and reducing the possibilities of errors to almost nil. Below are selected examples of processes that benefitted from automation.Shift allowance calculation: The client gave a shift allowance to its employees working in processes for international clients across different time zones. The allowance was calculated by taking the swipe-in/swipe-out timings from multiple backend systems. This process which was done manually, was time consuming and the scope of error was high owing to the large set of data.Infosys BPM designed the RPA bot to automatically read and validate the data from the multiple backend systems and calculate the allowance.

Rpa In A Series Of Steps List

The bot did this periodically leading to on-time clearance of the allowances.The shift allowance automation led to a 65% reduction of manual efforts and 83% reduction in average handling time (AHT) with zero errors.Background verification for new employees: This process involved cross-verification of details such as name, and date of birth for each interviewed candidate against a set of multiple databases, each holding hundreds of thousands of records. The processing volume and time taken grew exponentially every year owing to the increase in the candidates interviewed and the level of accuracy expected for such a critical process.Infosys BPM designed the RPA bot to receive the required details from the input sources, automatically cross-check the details with the backend databases, and create the process reports at the end of operation without any manual intervention. All the interim reports are reconciled into a final master report which is then automatically uploaded into the backend system in a scheduled manner. The enormous processing load is split across multiple bots to deliver the results in a short time.The background verification automation resulted in 85% reduction in total manual effort involved and 35% reduction in average processing time with zero errors ensuring no compliance faults.Generation of offer letters for new employees: This process entailed a series of steps which needed to be adhered to perfectly for compliance to regulations without compromising on accuracy. The AHT was approximately 15 minutes per new employee owing to the manual steps involved.Infosys BPM automated the entire process and reduced the processing time by 90% without compromising on the procedural steps and regulations.Scheduling of client training programs for new employee: Client scheduled training programs need to be blocked in the new employees’ calendars along with their respective dates and location details.